Bay Area, silicon valley, Unicorn, startups

Remember, We work?

That was a Unicorn strategy done wrong!

SoftBank, one of the most known investors in the Tech world, had an additional $6.6b of losses in WeWork after it reported $16.7b of losses on its Tech Fund.

Owing to so many challenges, having a billion-dollar valuation doesn’t guarantee the health of a Unicorn.

Now, what is a unicorn, you ask?

A mythical creature.

Simple.

But when we talk about tech companies, Unicorn was a term established by investors who had their eyes on companies, especially startups that promised valuation of over $1 billion.

Incepted almost a decade ago, Aileen Lee popularized the term ‘Unicorn’. The name implies the rare and nearly mythical quality of these firms, disruptive and competitive. But while still powerful, they are not so unique anymore.

With close to 500 companies in the unicorn club, this unsustainable growth, no matter the cost, makes it difficult for these companies to manage the resources. Unicorn is now being held responsible for keeping everything at stake for the sake of growth and development.

But how did Unicorn companies thrive this long?

When we use the term higher valuations in the definition to explain unicorn valleys, we mean finding and hiring the best talent, garnering a broader consumer base, and aiming for a 15% weekly growth. If that results in success, investors would put a significant amount in such companies and increase their valuation.

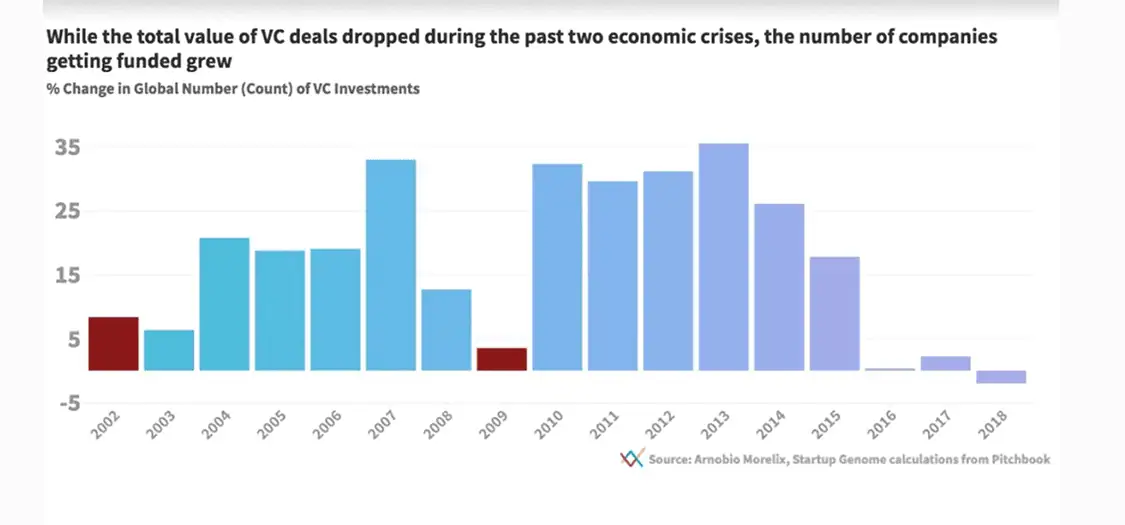

Credit: https://venturebeat.com/business/startup-genome-the-coronavirus-is-hurting-global-startup-investments/?mc_cid=91ef797a9c&mc_eid=ea0e001cad

But as predicted by Silicon Valley veterans, Unicorns were doomed to fail at some point because of their imbalanced and unrealistic approach. Undoubtedly those were successful in creating a perfect illusion for the investors, who are now left scratching their heads.

Often, Unicorns are considered a failure because they do not promote higher business practices, and their only aim is productivity at any cost, which is not suitable for the long run.

But 2019 saw prominent tech CEOs stepping down as they anticipated their methodical approach taking the company south. Further to this, many unicorn believers contemplate whether or not they should proceed with this approach.

A Stanford University study of US companies found that unicorns are usually priced 48% above their fair value. They also stated that their value is often inflated, ranging from 5% to 188%. Not the best bill of health coming into a pandemic of this stature.

Startups and investors have now come to understand that the businesses need to have their team, work and processes streamlined in a manner that ensures hypergrowth, not just in the form of a goal but also something that one will be held accountable for. At some point, the valuation was a peak which startups aspire for, is now being seen as an overrated non-sense that overlooks sustainability.

Credit:https://24tv.ua/ru/globalnaja_jekonomicheskaja_shahmatnaja_doska_i_ukraina_n1333680

The investment community is thinking on this seriously and advising businesses to look back and introspect before taking any step further or getting ahead with the direct listing.

High valuation may be able to convince the investors, but that does not mean they will be able to run a good business. Chasing high valuation should have never been the goal, and now investors and startups are starting to realize it.

Understandably, being an innovation centre comes with severe responsibilities and social cost, especially if your product/service goes bankrupt.

Startups in the last crisis of 2008 contributed heartily to the economic recovery, where employment in the IT industry grew while job creation in the overall economy was negative. Over 50 tech unicorns founded during the 2007-2009 recession years, jointly valued at USD 145.2 billion.

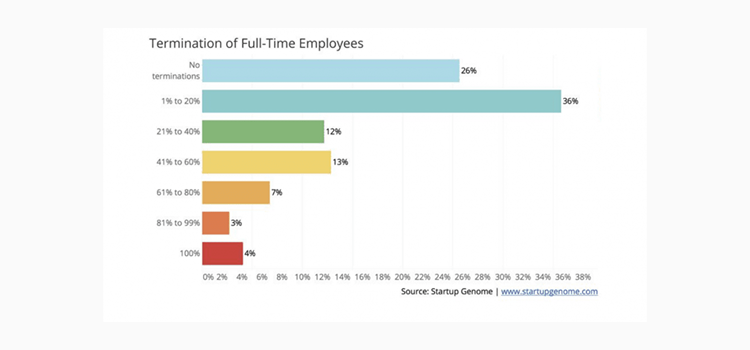

Credit: https://thenextweb.com/news/coronavirus-may-lead-to-mass-extinction-of-tech-startups-worldwide

A Startup Genome global survey reveals that 74% of startups have had to let go of their full-time employees, and 65% of all companies have less than six months’ worth of cash.

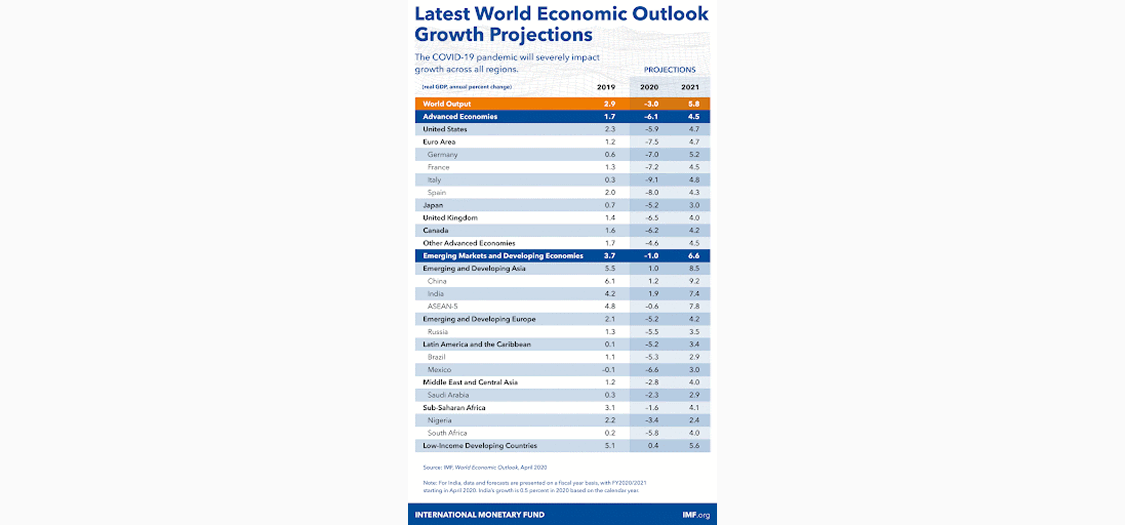

And well, in 2020, the ‘business as usual’ is no longer a cliche, thanks to Coronavirus. From the US to Europe to Asia, sharp GDP declines accompanied by record-high unemployment rates have plunged many economies into recession, further affecting the Unicorns the most, and in many cases losing their prized horns.

Who are all there in the zoo of business?

We have The Zebra, The White Elephant, The bulls and Bears, The Black Swan, The Cash Cow, The Gorilla, The Lame Duck, The Shark, The Vultures and Locusts, The Camels, and definitely more to venture.

Investment strategists like Roughol to come up with a new term, Zebra, for companies that aim to gain profit sustainably.

Why Zebra, you ask?

Because just like Zebra prints, these strategies can help a company/business gain profit without overlooking the societal impact. A win-win for both with no compromise on the revenue or sustainable growth.

Then there is another animal that has been the talk of the town, which is Camel. Similar to Camel’s inherent ability to survive in drought with water stored in its hump, using this strategy company can monetize at the time when they see opportunities flooding but can also survive when there are hurdles in getting investors. Unlike unicorns, camels can withstand even the climate’s harshest and sprint back when the time is right. Camels are startups that balance accelerated cash flow and steady growth.

What makes camel Silicon Valley’s latest reliable company is to invest in?

Consumers are looking for solutions that are worthy of the penny they are paying. They are not chasing companies that have high profits or. are a brand in the market. Camel startup to understand that consumers are willing to pay any price for reliable, efficient products/services. No customer is looking for a free product for as long as the offered ones add value to their life. Furthermore, earlier, companies giving away gifts or products at a subsidized rate have started to realize that this old school method is no longer going to work for growth in the current landscape.

It helps the company understand how they can leverage from maintaining a proper cost structure that would help them build revenue, or more a sustainable development culture and be resistant to any commercial or investment failure they might face in the coming years. This approach will help the startup grow and develop in the long run.

Venture capital makes for a great tool to raise money, and while called a startup to invest in it, they are cautious in doing so. They only grow a certain amount for individual work, which works as a potent way of strategically placing their money and staying safe if and when they want to exit or have to.

With keeping a long-term view in mind and survival being their ultimate goal, camel startups move ahead with higher resilience and a balanced growth strategy, giving them the freedom to invest when there is an opportunity and head back to sustainable growth when needed. This strategic approach of theirs to manage keeping long term view in mind and ability to stand firm when the market is shaming is making it Silicon Valley’s go-to strategy for a significant portion of a startup.

Startups find themselves divided between camels and zebras.

The world is moving towards the era of responsible growth. It would be best if you were cautious and considerate before making any significant decision about business growth and investment.

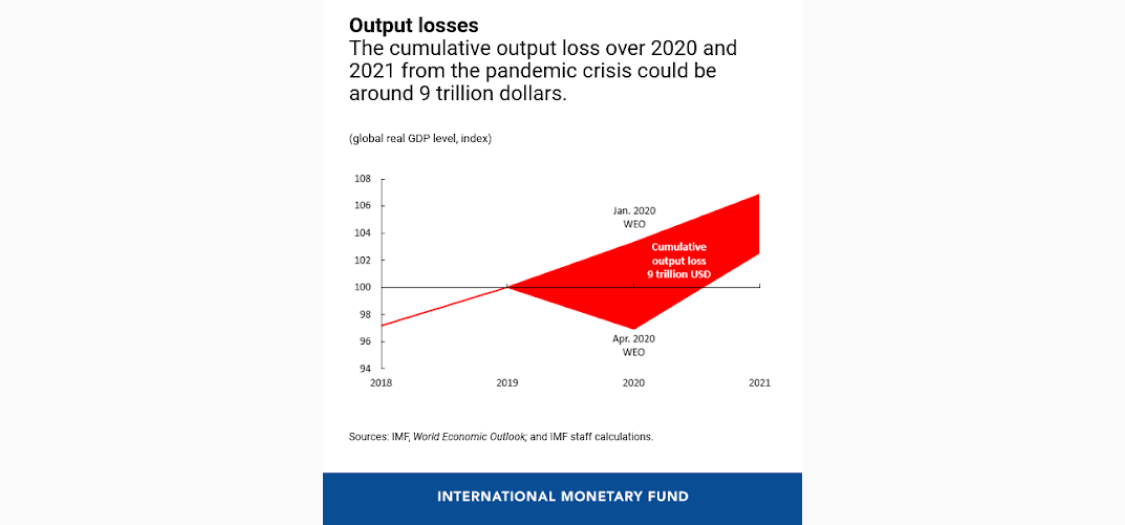

Credit:- https://www.imf.org/en/Blogs/Articles/2020/04/14/blog-weo-the-great-lockdown-worst-economic-downturn-since-the-great-depression

Unicorns, camels, or zebras, the ultimate goal is to find and continue with a perfect balance between sustainable growth and profitability. Businesses need to decide how they wish to grow without compromising on sustainability. The right choice will help them build a long-lasting company that will thrive in the long term.

The silver lining in COVID-19 is driving digitization like no other event since the dot-com boom. With the advent of AI, IoT, and Machine Learning and Wearables, almost all industries have a significant digital push, be it healthcare, food, finance, education, or manufacturing. We are far more connected and resilient than before, and the ultimate goal of providing the best services is pumping up us to deliver more.

According to The International Monetary Fund, the immediate outlook looks bad, and it is expected that the global economy might go down by – 3% in 2020. Unfortunately, much worse when compared to the 2008–09 financial crisis. But they also forecast that as soon as economic activity normalizes, it will bounce back with the growth of 5.8%, far quicker than the GFC.

The fact that Uber, Slack, Airbnb, WhatsApp, Instagram, and many others came out of the last recession, we can be hopeful for another disruption and mythical yet seem to be real creatures around, the ones which are more innovative and will come out of this pandemic.

Subscribe to Saffron Tech

Explore your marketing zen with our newsletter! Subscribe now.